Our History

Dan Started his career as a life insurance field representative For Grange Insurance covering the midwest in 1978. In 1982 he founded Loy Insurance Agency in Columbus, OH and has served personal lines customers for 36 years. In 2015 his son DJ joined the agency focusing on commercial risks.

Insurance can be a complicated purchase. You’re not buying bread or milk. You’re buying a promise of protection that could potentially make or break your financial well-being. How do you know that you’re making the right choices about coverage? Are you sure you’re getting the best possible value for your dollar? The options can seem overwhelming.

Why do business with Loy Insurance?

Unlike a captive, or direct insurance company who only offers their own proprietary products, our agency is 100% independent of any one company. Many insurance consumers don't fully understand just how important that really is.

When it comes to something as important as insurance, it's imperative that you work with an agency who has an in-depth knowledge of multiple insurance products, companies, and guidelines — not just one.

At the end of the day, what separates one agent from another, is their ability to proactively service their policy holders, and their knowledge of the insurance industry, products, and different situations that may present themselves to their clients.

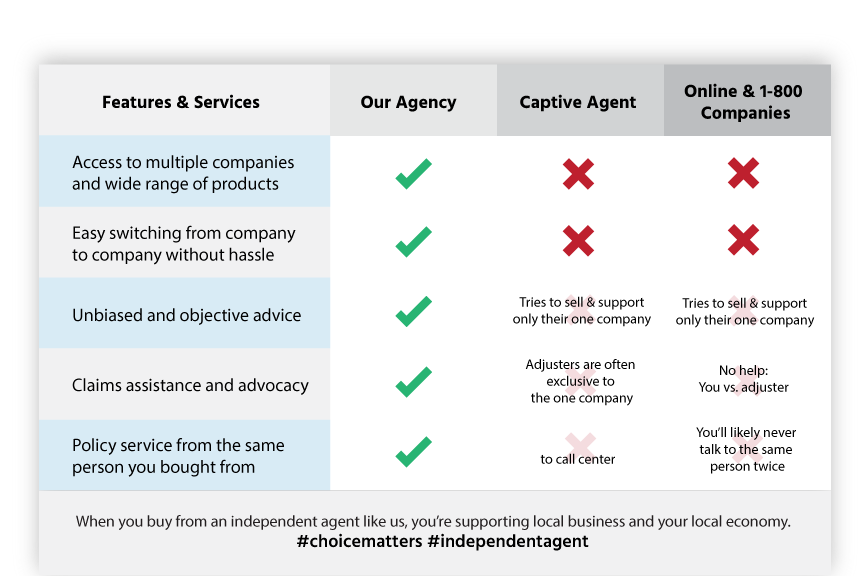

Independent Agent Vs. The Rest

Here is a quick comparison of the differences between an independent agency like us, and the various other types of companies that are out there:

If you'd like to get started with a complimentary quote and/or policy review, we'd be happy to help you any way we can. Simply complete the fields below to get started online in a matter of seconds.

We appreciate the opportunity to help you, and look forward to servicing your insurance needs! Feel free to call us directly if you have more detailed questions.